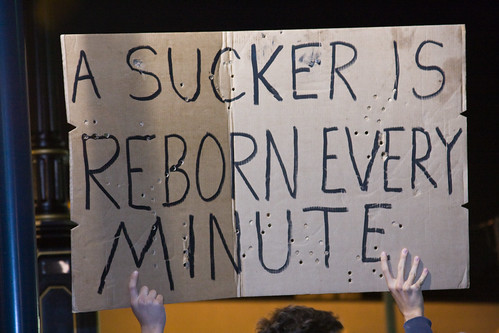

But just to be sure, I did an internet search. And there it was, multiplied five times, on five different websites. My favorite is this photo someone put on Flickr:

Just made me think about all the other "bright ideas" I've had over the years, back in the days before the Internet. Sigh . . . Guess I'm not as original as I thought I was.

Nevertheless, there is a great truth hidden in my minor embarrassment. A sucker really is reborn every minute. Because all the old misconceptions, miscalculations, fantasies, illusions and delusions -- they're a'comin back, big time.

One of the biggest suckers of them all, Ben Bernanke has certainly been reborn, with wings a'flappin'. Here's the NY Times headline: Fed Chairman Says American Economy Is Poised to Grow. Read all about it:

Ben S. Bernanke, the chairman of the Federal Reserve, offered his most hopeful assessment in more than a year on Friday, asserting that “the prospects for a return to growth in the near term appear good.”The Times reporter isn't quite buying it, though:In a much-awaited speech here to central bankers and economists from around the world, Mr. Bernanke went beyond the Fed’s most recent assessment that the nation’s economy was “leveling out” and that the recession was ending.

Noting that short-term lending markets are functioning “more normally,” that corporate bond issuance is strong and that other “previously moribund” securitization markets are reviving, Mr. Bernanke said that both the United States and other major countries were poised for growth.

Not to mention all those hundreds of billions in "toxic assets" still lingering unsold in the banking system. Nor the ongoing meltdown in commercial real estate. Nor the millions of impending mortgage foreclosures. Nor the inconvenient truth that this country no longer has anything much to sell in the world marketplace, meaning that unemployment will remain high for the indefinite future, so where is all the consumption the economy needs in order to recover. Not to mention the question of why anyone in his right mind would want the old economy to recover, which would only mean the re-inflation of all the old bubbles.In emphasizing not just the imminent end of the recession — the worst since at least the early 1980s if not since the Great Depression — but also the “good” chances of actual growth, Mr. Bernanke’s assessment was in some ways surprising.

Despite encouraging signs on many fronts, American retailers have reported unexpectedly weak sales in the last week — a sign that that consumer spending could drag down economic growth in the months ahead. And on Thursday, the Labor Department reported that new unemployment claims jumped again.

Maybe Bernanke is playing us for suckers.

No comments:

Post a Comment