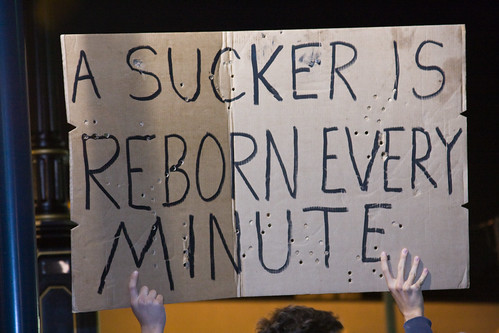

However, it's occurred to me that some of you guys over at Goldman Sachs probably are geniuses, just like everybody says. And, assuming you finally got your High-Frequency Trading software back, which enables you to do so many thousands or millions (whatever) trades a second, and assuming you're too arrogant (why shouldn't you be, you're geniuses, right?) to care what everyone's saying about this type of software making it possible to manipulate the market "in unfair ways," then I have a proposition for you. Because after all, becoming world famous is probably even more of an incentive than making lots of money, and by doing what I'm suggesting you do, you will definitely become world famous, so . . .

Here's the challenge. Take a good look at my cartoon. Do a bit of genius type thinking. And figure out a way to use your really amazing software to do something even more amazing than has ever been done in history. Use every bit of programming skill you can muster and actually do in real life what I've only dreamt of in my cartoon: sign your name to the Goddamned Dow by manipulating the Hell out of it, microsecond by microsecond, just make it dance to your tune all the way from the opening bell to the closing bell -- and listen for the huge round of applause you'll get at the end of that trading day.

Don't worry. You won't get arrested. Because signing the Dow is not, last time I checked, against the law. And if you get fired, so what? The genius that can do this trick can do anything with the market, so you'll be getting plenty of offers.

Hey, if a group of Japanese chemists can manipulate bacteria to draw a picture like this,

then a red blooded, blood sucking, shameless and greedy American trader ought to be able to do something even more spectacular -- and egotistical -- with the Dow.

Go for it guys. Let's see who can get there first.